The Electricity Behind the AI Bubble: What Happens When the Music Stops

I’ve seen this movie before. Not the AI part.

The 1999 pattern. Money flowing and dreaming like it would never stop. Then it did.

Right now, I’m watching three signals that tell me the AI bubble isn’t coming. It’s already here. Already cracking.

And unlike the last time around, this one comes with a bill that’s landing on electricity meters whether customers use AI or not.

The AI Optimist Content reflects personal opinions from a business perspective. Not legal, financial, or professional advice. See full disclaimer.

Signal 1.

When Money Moves Without Moving Anything

During the dotcom era, I got a call from a CEO. Here was his pitch:

“Send me an invoice for $1 million in advertising services. I’ll send the money. You keep $100,000 and send me back $900,000. That’s it.”

Maybe it made his balance sheet look flush, investors happy?

I said no. Some people said yes. Things got messy for those in the deal.

Today, I’m watching OpenAI, Nvidia, and AMD play a version of that same game. The names are different.

The mechanics are identical. And the scale is infinitesimally higher.

OpenAI locks in massive Nvidia chip orders: $100 billion in future commitments. That’s not a conventional purchase. That’s a confidence play.

It tells the market: “We’re so committed to this future that we’re locking in enormous obligations.”

Nvidia’s stock rises because the story feels real. The money for those chips isn’t there yet. But the promise is.

AMD gets a different arrangement. OpenAI doesn’t have the cash flow to buy chips outright, so it takes stock warrants at incredibly low prices.

When AMD’s stock goes up, OpenAI may exercise those warrants, sell the shares at a profit, and use that cash to buy the chips.

AMD’s stock price becomes OpenAI’s funding mechanism. Not like an investment in AMD’s product. A bet that the AI hype story keeps going long enough for the stock to rise.

When the hype cools, when AMD’s stock stops moving up?

OpenAI probably won’t convert those warrants. Not buy the chips. And the whole thing seizes up.

That’s not a partnership. That’s financial dependency dressed as a deal.

In dotcom, we called it financial engineering. Today it’s strategic partnerships, strategic investments, and strange shuffling of the appearance of money.

Sort of like Bitcoin but no blockchain. Who needs mining?

But no money really goes around. And when that happens at scale, that’s a signal that things are starting to crack.

Signal 2.

The Dead Internet Isn’t AI’s Fault. We Built It First.

Everyone’s mad about AI slop. Low-quality content everywhere. Garbage, noise, automation replacing human voice.

AI didn’t break the internet. It just reveals something broken for years.

We trained ourselves first. Google taught us to please the algorithm. Everything around search engines was designed to please Google’s ranking system.

Then social media took over. Facebook, Instagram, TikTok. We followed the algorithm, which told us exactly what type of content to create, and then we served it.

Rage content. Engagement-bait. Optimized slop.

We didn’t stumble into this. We built an internet where garbage pays. It’s been paying for years.

AI didn’t invent slop. It industrialized it.

The most successful AI companies? Not profitable. Not even close. They need something to justify the cost.

More users. More data. More content. So what do they do? Generate more slop. Faster. Cheaper.

Slap ads around it, like the next Google Search.

But we’re already drowning. The content isn’t solving a problem.

It’s proving there isn’t a business here yet. When you’re building something real, it speaks for itself. When you’re in a bubble, you drown the signal in noise.

That noise is built on something, though. Something real. Something expensive.

Here’s where it gets tangible: infrastructure. Electrical grids. Real cost. Real risk.

The Electricity Bet Nobody’s Planning For

I think about a company I knew during dotcom. A friend worked there. The owner got offered $1 billion to sell. Said no.

“We’re just getting started.”

A year later? Gone. The thing everyone paid $1 billion for didn’t exist.

It was never about business. It was about the story.

History sort of repeats, but this new bubble is built on electricity demand created by AI, and us.

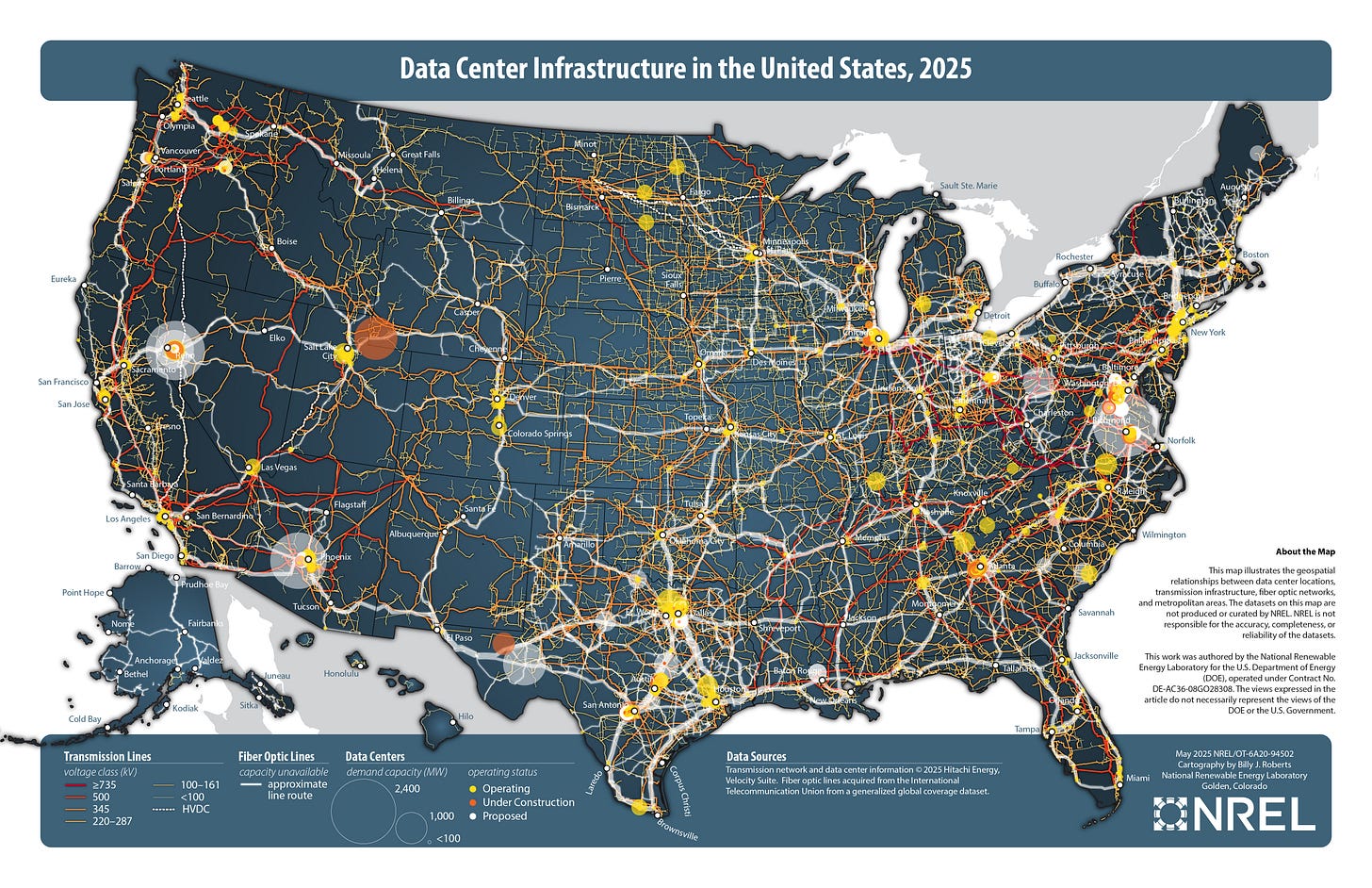

Every major tech company is betting billions on data centers. Massive electrical infrastructure.

These aren’t theoretical expenses. They’re happening now.

(SOURCES AT BOTTOM OF THE PAGE)

OpenAI’s Stargate Project alone is planning five new megafacility data center sites across Texas, New Mexico, Ohio, and the Midwest, with nearly 7 gigawatts of total capacity and over $400 billion in committed investment.

That’s just OpenAI.

· Amazon’s building $20 billion in AI data center campuses in Pennsylvania.

· Meta’s Louisiana facility is a $10 billion project.

· Compass is planning a $10 billion Mississippi facility.

· Microsoft’s Wisconsin project is $3.3 billion.

Add in major projects from Cologix, Google, and others: planned investment exceeding $100 billion in data center infrastructure across the country.

Each of these megafacilities consumes electricity equivalent to powering 100,000 homes.

Some estimates suggest individual data centers will rival the power consumption of small cities.

What happens when not all of these survive?

The Real Bubble: Your Electric Bill

Tech companies are building for a future where they all win. But in a bubble, most lose.

When they lose, the infrastructure doesn’t disappear. It just becomes someone else’s problem.

That someone else might be you.

Wholesale electricity costs as much as 267% more than it did five years ago in areas near data centers. (Sources at bottom)

A new analysis found $4.3 billion in costs in 2024 alone for just seven states: Illinois, Maryland, New Jersey, Ohio, Pennsylvania, Virginia and West Virginia. These are costs for grid connections and infrastructure to support data centers.

Paid for by residential customers.

The U.S. power grid isn’t equipped for this. Goldman Sachs estimates that about $720 billion of grid spending through 2030 may be needed to support data center demand.

Data centers consumed 183 terawatt-hours of electricity in 2024—more than 4% of the country’s total electricity consumption. By 2030, this is projected to grow by 133% to 426 terawatt-hours.

And water. These facilities need massive amounts of potable water for cooling. In 2023, data centers consumed about 17 billion gallons of water.

Hyperscale facilities alone are expected to consume between 16 billion and 33 billion gallons annually by 2028. In some regions, this is already challenging water tables.

What happens to that infrastructure if the company building it loses the AI race?

The Pattern We’re Repeating

During dotcom, we overbuilt server farms, fiber lines, internet capacity everywhere.

When the crash came, it all became worthless. Stranded assets. Dead infrastructure.

The difference is what happened after. That infrastructure became the foundation for the internet we have today.

Someone had to pay for that cleanup. Consumers did. Gradually. Over time.

But this is different. The infrastructure failure isn’t theoretical. It’s baked into your power grid.

When this pops, you don’t just lose stock value. You might lose grid stability. Cost of living goes up. And nobody’s planning for the cleanup.

The Signal Is In The Silliness

If something seems silly, it is. You don’t have to be a billionaire to understand that when tech companies are structuring deals where their suppliers’ stock prices become their own financing mechanisms, while generating endless content that doesn’t create value, games are being played with this much money.

OpenAI alone is planning six Stargate sites. Amazon, Meta, Microsoft, Google, and others are building dozens more across the country. Billions in infrastructure committed.

All based on the assumption that the AI story keeps going up. All based on the assumption that these companies will be profitable. All based on the assumption that every project gets built and survives.

Most won’t.

When the crash happens, you’re going to have enormous electrical infrastructure sitting idle. Data centers that never got built. Grid capacity expanded for demand that evaporated?

Maybe. Your electric bill will carry that cost. Pretty much guaranteed.

The difference between surviving a crash and being blindsided by one is seeing the signals.

The money shuffle. The endless slop. The infrastructure bet.

They’re all here. All visible. All converging.

And when this does pop, that electricity bill will remind you exactly why AI is not like Dotcom. We all have a stake.

Further reading:

Wall Street analysts explain how AMD’s own stock will pay for OpenAI’s billions in chip purchases

PEW Research: What we know about energy use at U.S. data centers amid the AI boom

Bloomberg: How AI Data Centers Are Sending Your Power Bill Soaring

CNBC: Utilities grapple with a multibillion question: How much AI data center power demand is real

Union of Concerned Scientists: Data Centers Are Already Increasing Your Energy Bills

TechPolicy.Press: How Your Utility Bills Are Subsidizing Power-Hungry AI

Goldman Sachs: AI to drive 165% increase in data center power demand by 2030